Bitstamp announced that it will begin distributing assets from the defunct Mt. Gox exchange to creditors tomorrow. The exchange has received these assets and is processing them for distribution.

Customers are asked to be patient, as security checks may take up to a week. UK residents will have a separate distribution plan, with updates provided once transfers are complete.

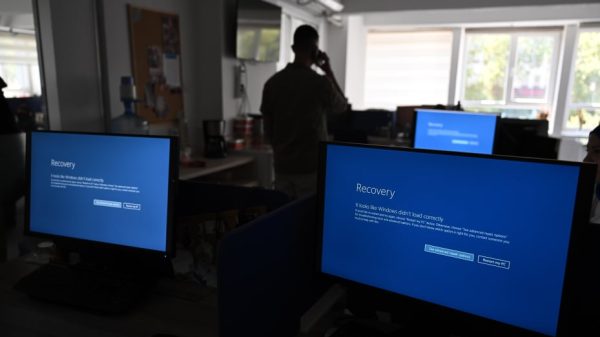

Bitstamp

Kraken also confirmed receiving their share of the assets yesterday but did not disclose the exact amounts, leaving creditors uncertain about the total value they will receive.

Mt. Gox, once a Bitcoin giant handling over 70% of all transactions, collapsed in 2014 after a massive hack resulted in the loss of approximately 740,000 bitcoins. Today, that amount is worth around $15 billion.

Following numerous delays and court battles, the repayment process is finally underway. The Tokyo District Court has set an October 2024 deadline to complete the repayment plan.

Nobuaki Kobayashi, the Rehabilitation Trustee, has been working on the plan, which includes distributing Bitcoin (BTC), Bitcoin Cash (BCH), and Ethereum (ETH) to affected investors.

The commencement of these repayments is already causing ripples in the crypto markets, coinciding with bullish catalysts like spot Ethereum ETFs.

Early investors are receiving assets at much higher values than their initial investments, potentially leading to sell-offs and increased market selling pressure.

The crypto community is closely monitoring how these distributions will impact the prices of Bitcoin, Bitcoin Cash, and Ethereum.